Overview

Listed as a leading junior by the legal directories, Joseph is described as a “boon to those that instruct him” (Chambers UK 2025), “a great junior barrister who is user-friendly, impressive on the law and robust on his feet” (Chambers UK Bar 2020), and “[having] an extremely impressive command of the law and a devastating advocate” (Chambers UK Bar 2022).

Joseph has a broad practice which covers the full range of commercial litigation and arbitration, with a particular focus on insolvency, civil fraud, company law, banking and financial services. Joseph’s cases often involve an international element and applications for pre-emptive and interlocutory relief, including freezing orders, Norwich Pharmacal orders and other interim injunctions.

Equally at home working with solicitors as sole counsel or as part of a wider counsel team, he is instructed in commercial disputes in the English courts and in arbitration and also offshore, including in particular in the Dubai International Financial Centre. Current and recent instructions include:

Re Petropavlovsk PLC:

Acting (with Peter Arden KC) for the officeholders of Petropavlovsk PLC, including in relation to their application for liberty to proceed with the sale of assets to a Russian company for <$600m and their application for the sanction of 3 proposed parallel schemes of arrangement.

Adie & Cooper v Ingenuity Digital Limited:

Acting as sole counsel for the defendant company in this post-M&A dispute in which the claimant sellers have challenged the calculation of deferred consideration due, including through seeking declarations on the interpretation of the deferred consideration calculation provisions in the SPA and the relationship between that calculation and potential indemnity claims.

Re SHP Capital Holdings Ltd:

Acting as sole counsel for the officeholders on this high-profile insolvency. SHP’s primary business was a funeral planning business whereby 46,000 members of the public paid monies for funeral plans in the belief their monies would be held on trust for that purpose. The officeholders have established a significant shortfall (many £millions) and are seeking to recover it, including through the pursuit of a number of various claims.

Giwa vs JNFX Limited et al:

Acting (with Catherine Addy KC) for the defendant company in opposing the claimant’s claim relating to foreign exchange transactions allegedly entered into by JFNX with the claimant to exchange Nigerian naira for >$75 million.

Emirates NBD and others v Advanced Facilities Management et al:

Acted (with Sharif Shivji KC, Emma Horner and Hossein Sharafi) for the defendant borrowers in this complex banking dispute in the DIFC in which the claimant banks claimed >$500 million under a syndicated loan agreement.

Asher et al v Jaywing PLC:

Acted without a leader for the successful defendant PLC in this post-M&A dispute centred on the terms of the SPA which provided for the acquisition of a company by the defendant and for £multi-million earn-out payments subject to the company’s performance.

Glenn Maud; Aabar Block SARL v Maud:

Acted from 2015 to 2020 (both as sole counsel and led variously by Peter Arden KC and Andrew Clutterbuck KC) for property tycoon, Glenn Maud, in opposing a bankruptcy petition on an alleged debt of £51 million presented by an investment company financed by the Abu Dhabi sovereign wealth fund and a company associated with Robert Tchenguiz.

Areas of expertise

-

Commercial Dispute Resolution

Joseph, described by the directories as having “notable capabilities in … commercial litigation…” (Chambers UK Bar 2021) and ranked as a leading junior for commercial work in The Legal 500 Middle East English Bar, Joseph advises and acts in a broad range of complex and high-value commercial litigation. Current and recent instructions of note include:

- Adie & Cooper v Ingenuity Digital Ltd [2024] EWHC 2902 (Ch): Acting as sole counsel for the defendant company in this post-M&A dispute in which the claimant sellers have challenged the calculation of deferred consideration due, including through seeking declarations on the interpretation of the deferred consideration calculation provisions in the SPA and the relationship between that calculation and potential indemnity claims.

- Power Projects Sanayi Insaat Ticaret Ltd Sirketi v Star Assurance Co Ltd [2024] EWHC 2798 (Comm): Acting as sole counsel for the defendant company on its application disputing that CPR Pt 8 the appropriate procedure for the claimant’s claim for payment of $6 million under an on-demand performance bond.

- Giwa vs JNFX Limited et al: Acting (with Catherine Addy KC) for the defendant FCA-regulated company in opposing the claimant’s claim relating to foreign exchange transactions allegedly entered into by JFNX with the claimant to exchange Nigerian naira for >$75 million.

- Emirates NBD and others v Advanced Facilities Management et al: Acted (with Sharif Shivji KC, Emma Horner and Hossein Sharafi) for the defendant borrowers in this complex banking dispute in the DIFC in which the claimant banks claimed >$500 million under a syndicated loan agreement.

- Asher et al v Jaywing PLC [2022] EWHC 893 (Ch): Acted, leading Josh O’Neill, for the successful Defendant PLC in a 2-week trial in the High Court opposing a claim for £multi-million earn-out payments allegedly due under an SPA or alternatively under an allegedly freestanding oral agreement notwithstanding a ‘No Oral Modification Clause’.

- A telecommunication provider v A Canadian technology services provider: Acted as sole counsel for the defendant in opposing the claimant’s <$9 million claim for damages for alleged breach of contract.

- Saboowala v (1) Nair (2) Veluthedath (3) RAG Foodstuff Trading LLC (CFI 037/2017): Acted in the DIFC courts as sole counsel for the defendant in dispute arising out of an SPA to acquire the entire shareholding of a commodity trading business.

- A Company vs A BVI Company: Acting as sole counsel for a former shareholder in a company which operated an internet flights comparison website on its claim for deferred consideration in excess of £12 million following the reorganisation and sale of the company for £30 million.

- An oil & gas promoter v A global commodities supplier: Acted (with George Bompas KC) on the claimant’s <$8 million claim in arbitration for unpaid fees under an agency agreement for the development of business importing liquified natural gas into Egypt.

- Passport Special Opportunities Fund, LP v ARY Communications Ltd et al (CFI 039/2016): acted as sole counsel for the applicant on application in the DIFC to set aside immediate judgment order enforcing a Singapore judgment.

- A Company vs A BVI Company: Acting (with John Brisby KC) for a former shareholder in a company in relation to its claim for deferred consideration in excess of £4 million pursuant to a share sale and purchase agreement.

- Corinth Pipeworks S.A. v Barclays Bank PLC v (1) Afras Limited (2) Radhakrishnan Nanda Kumar: [2010] DIFC CFI 024 (21 April 2014): Acted (with John Brisby QC) in DIFC for the Part 21 defendants in their application to strike out Barclays’ claim for a contribution in respect of the claimant’s claim against Barclays in deceit and/or negligence and/or unlawful conspiracy for damages of over US$24 million.

- Global Energy Horizons Corp v Gray: Acted (with variously Stephen Atherton KC, Stephen Gee KC, David Cavender KC, Andrew Clutterbuck KC and Conn MacEvilly) the defendant in opposing a claimant energy investment company’s claim for an account of profits in breach of fiduciary duty in diverting from it a number of business opportunities relating to a potentially revolutionary oil and gas technology, culminating in a three-week liability trial before Vos J in 2012 ([2012] EWHC 3703 (Ch)) and six-week enquiry before Asplin J in 2015 (([2015] EWHC 2232 (Ch)) and numerous subsequent interim hearings.

- Aberdeen Global v Satyam Computer Services Ltd: Acted (with Anthony de Garr Robinson KC and Andrew Clutterbuck) for the claimant on claim for damages in deceit against Satyam arising out of a fraud (described as ‘India’s Enron’), including on the hearing of Satyam’s application for a stay of proceedings on forum conveniens grounds before Gloster J – while judgment was pending, the parties agreed to settle the claim for $68 million.

-

Insolvency & Restructuring

Joseph is ranked as a leading junior for insolvency in the Legal 500, having been described in Chambers and Partners as “…extremely knowledgeable in relation to the technicalities of insolvency law…” and having “…notable capabilities in contentious insolvency…”.

Insolvency and restructuring forms a significant part of Joseph’s practice. He appears regularly (on his own and led) in the High Court, including in relation to both corporate insolvency and bankruptcy, advising and acting for petitioners, insolvency practitioners, creditors and debtors, including in relation to disputed winding-up petitions, injunctions to restrain presentation/advertisement of petitions; setting aside statutory demands; bankruptcy hearings, validation orders, rescission/annulment; administration and associated applications; schemes of arrangement and restructuring plans; claims against former directors under the IA 1986; and transactions at an undervalue/preference. Current and recent instructions of note include:

- Re SHP Capital Holdings Ltd: Acting as sole counsel for the officeholders on this high-profile insolvency. SHP’s primary business was a funeral planning business whereby 46,000 members of the public paid monies for funeral plans in the belief their monies would be held on trust for that purpose. The officeholders have established a significant shortfall (many £millions) and are seeking to recover it, including through the pursuit of a number of various claims.

- Re Richard Wells: Acting as sole counsel for the officeholders on the bankruptcy of the sole shareholder and former director of SHP Capital Holdings Ltd.

- Re Petropavlovsk PLC: Acting (with Peter Arden KC) for the officeholders of Petropavlovsk PLC, including in relation to their application for liberty to proceed with the sale of assets to a Russian company for <$600m ([2022] EWHC 2097 (Ch)) and their application for the sanction of 3 proposed parallel schemes of arrangement ([2023] EWHC 264 (Ch); [2022] EWHC 3448 (Ch)).

- Re CGL Realisations Limited (Formerly Comet Group Limited): Acted as sole counsel for the additional liquidator on this high-profile insolvency, including on his successful applications to draw additional remuneration and to be removed as a liquidator and be discharged from liability.

- Albert Court (Westminster) Management Company v Fetaimia: Acted for the petitioner in these long-running bankruptcy proceedings, appearing at multiple hearings culminating in the refusal of the bankrupt’s application for permission to appeal ([2024] EWHC 1307 (Ch)).

- Re ZF&D LTD: Acted for the liquidators in successfully opposing applications by the company’s former director and shareholder to stay the voluntary winding-up, remove the liquidators and disallow their remuneration.

- Re Glenn Maud; Aabar Block SARL v Maud: Acted from 2015 to 2020 (both as sole counsel and led variously by Peter Arden KC and Andrew Clutterbuck KC) for property tycoon, Glenn Maud, in opposing a bankruptcy petition on an alleged debt of £51 million presented by an investment company financed by the Abu Dhabi sovereign wealth fund and a company associated with Robert Tchenguiz (see [2020] EWHC 1469 (Ch); [2020] EWHC 974 (Ch); [2019] EWHC 398 (Ch); [2018] EWHC 1414 (Ch); [2016] EWHC 2175 (Ch); [2016] EWHC 1319 (Ch); [2015] EWHC 3681 (Ch).

- Re Derek Quinlan; Quinlan v Edgeworth Capital (Luxembourg) SARL: Acted (initially with Michael Fealy KC and then leading Lara Hassell-Hart) for Irish businessman, Derek Quinlan, both (1) in his claim for an injunction restraining Edgeworth, a company associated with Robert Tchenguiz, from pursuing a bankruptcy petition on a debt of approximately €119 million, and (2) in opposing the petition itself.

- Deansgate 123 LLP v Workman [2019] EWHC 2 (Ch): Acted as sole counsel for the claimant in successfully opposing the defendants’ applications to strike out the claimant’s applications under s.423, IA 1986, on purported grounds of Henderson v Henderson abuse of process.

- Reliance Wholesale Ltd v AM2PM Feltham Ltd [2019] EWHC 1079 (Ch): Acted as sole counsel for the appellant petitioner before Morgan J on successful appeal against costs decision on dismissal of winding-up petition.

- Hussein v Hussein; Re Haus of Vanity Limited[2017] EWHC 2615 (Ch): appeared as sole counsel for the petitioning creditor/contributory on a winding-up petition on the just & equitable ground heard over two days before Chief Registrar Briggs.

- Reynolds Porter Chamberlain v Senator Khan [2016] B.P.I.R. 722: Acted as sole counsel for the petitioning firm of solicitors on this bankruptcy petition where the principal issue in dispute was whether the debtor, a citizen of Pakistan, had been resident in the jurisdiction.

- Edwards v Panesar [2016] EWHC 1944 (Ch): Acted as sole counsel for trustees in bankruptcy on successful application before Henderson J to set aside order striking out their appeal.

-

Chancery: Commercial

First ranked as a leading commercial chancery junior in the 2016 edition of Chambers and Partners and described in a subsequent edition as a “…talented junior who is building a considerable reputation among the Commercial Chancery Bar…”, Joseph has extensive experience in commercial chancery litigation and advice including fraud and asset recovery. Joseph acts in a broad range of litigation and advisory work in this field, appearing in both the Commercial Court and the Chancery Division as well as the DIFC courts, including in relation to the protection of minority shareholders’ interests through s. 994 petitions, derivative claims, just and equitable winding-up petitions and (for offshore jurisdictions) oppression claims, claims for breaches of fiduciary duties against directors, the construction of commercial contracts and the effect of equitable and legal assignments.

Examples of Joseph’s current instructions and recent experience of note in this area include:

- Acting as sole counsel for the potential claimant in protecting his interests as a minority shareholder in a Delaware-incorporated company and its wholly owned English subsidiary.

- Acting as sole counsel for the claimant purchaser of a commodity trading business on its claim arising out of a share sale and purchase agreement.

- Acting as sole counsel for the respondent in opposing a charge-holder’s application to release monies held in escrow to compensate relevant parties in respect of any interests, charges or claims in various properties following the closure of the titles thereto.

- Acting as sole counsel for the petitioning contributory on her petition to wind up a deadlocked company on the just and equitable ground.

- Acting (with Alan Maclean KC) for the applicant real estate companies on their application for urgent injunctive relief and their claim for consequential damages in respect of the entry of unilateral notices against their £2 billion property portfolio.

- Advising (with Jonathan Hall KC) the Crown Prosecution Service, Proceeds of Crime Unit, in relation to an investigation into suspected fraud and money laundering of over £1 billion as to various trust / concealment / evasion / corporate veil issues

- Acting (with John Brisby KC) for the defendants in opposing a substantial claim pursuant to s. 188 Law of Property Act 1925 to divide a highly valuable collection of Chinese porcelain held as tenants in common.

- Acting (with David Cavender KC and Conn MacEvilly) for the defendant in relation to a quantum enquiry into an account of profits arising out of a breach of fiduciary duty related to the alleged commercialisation of ultrasound oilfield technology.

- Acting (with Stephen Atherton KC and Andrew Clutterbuck) for the defendant in opposing the imposition of fiduciary duties allegedly owed to the claimant as part of a joint venture.

-

Company Law

Joseph has a strong company law practice, with particular experience in shareholder disputes, unfair prejudice petitions (s.994 petitions), just and equitable winding-up and substantial claims against directors and shareholders (for example questions of breach of duty, of directors’ authority (actual or apparent), and of return of dividends). Current and recent instructions include:

Acting as sole counsel for the potential petitioner in respect of his claim for unfair prejudice in respect of a valuable property development group of companies, including substantial claims for compensation against third parties.

Acting as sole counsel for the potential respondents to a claim for unfair prejudice in respect of a substantial group of companies which own and operate care homes.

Acting (with Andrew de Mestre KC) for the defendant PLC, which owns £4 billion of London real estate, in opposing a claim by shareholder, Hong Kong billionaire, Samuel Tak Lee, that a non pre-emptive placing by which Shaftesbury raised £265 million, was carried out for an improper purpose.

Acting as sole counsel for the potential claimant in protecting his interests as a minority shareholder in a Delaware-incorporated company and its wholly owned English subsidiary.

Advising a shareholder in an insurance brokers on a potential s. 994 petition on account of the majority shareholders’ actions in restructuring the business.

Advising a company on potential breaches of ss. 691-694 CA 2006 in purchasing its own shares.

Advising a director and 50% shareholder of a company as to how to protect his interests following the death of the only other director and 50% shareholder.

Acting as sole counsel for a company in relation to its claim against a former director and shareholder for breach of director’s duties and breach of non-compete provisions contained in a shareholders agreement.

-

Banking & Finance

Joseph has advised on and appeared in relation to numerous disputes relating to banking and financial services, including the mis-selling of investment products (particularly complex derivative products) to individuals and SMEs and large-scale litigation involving multi-national investment banks. Recent experience in this area includes:

- Acting (with Sharif Shivji KC) in proceedings in the DIFC, in relation to an AED 1.7 billion syndicated loan facility, which raised issues of duress, misrepresentation, and Sharia finance.

- Acting (with Richard Hill KC) for the proposed claimant in relation to his claim against a DFSAregulated bank for over US$4.5 million in damages on account of the bank’s misrepresentations and/or breaches of contractual/tortious/fiduciary duties as part of the banker-customer relationship

- Acting as sole counsel for the proposed claimant in relation to its proposed claim against its investment manager for damages in excess of US$2 million on account of losses suffered on its investment portfolio.

- Advising as sole counsel an internet television provider, the defendant to a claim by an FCA registered lender for repayment of monies lent, as to available defences and potential counterclaims including for damages on account of the lender’s alleged breach of contract in refusing to advance further monies.

- Acting as sole counsel for the claimant stockbroker in its attempts to recover trading debts from the defendant investor – key issues included whether the defendant was an ‘execution only’ client, whether trading was authorised and whether there had been an unauthorised extension of credit to the defendant.

- Acting as sole counsel representing the defendant trustee of a pension fund in relation to a claim brought by the fund’s stockbroker arising from a missed margin call in respect of put options in Northern Rock.

- Being seconded to a major international bank to assist with its review of its sales of interest rate hedging products, including structured collars, swaps, simple collars and cap products, to unsophisticated customers.

- Assisting Sharif Shivji in a two-week trial before Gloster J in the Commercial Court acting for a hedge fund in a test case about the duties owed by a bank in closing out a customer’s portfolio following a missed margin call.

-

Fraud: Civil

In circumstances where fraud does not lend itself to strict categorisation in particular practice areas or divisions, many of the matters on which Joseph is instructed, whether in the Chancery Division, the Commercial Court or in offshore jurisdictions, contain serious allegations of civil fraud and dishonesty. Examples of Joseph’s experience involving such allegations include:

- Acting (with John Brisby KC) for the additional defendants in their application in the DIFC to strike out Barclays’ claim for a contribution in respect of the claimant’s claim against Barclays in deceit and/or negligence and/or unlawful conspiracy for damages of over US$24 million.

- Acting (with Anthony de Garr Robinson KC and Andrew Clutterbuck) for the Aberdeen claimants who claimed damages in deceit against Indian company, Satyam, on the basis that they had been fraudulently induced (by means of a fraud described as ‘India’s Enron’) to purchase shares in Satyam in India – the claim was ultimately settled for US$68 million.

- Advising (with Jonathan Hall KC) the Crown Prosecution Service, Proceeds of Crime Unit in relation to an investigation into suspected fraud and money laundering of over £1 billion.

- Acting as sole counsel for N, a Russian national on his claim in unjust enrichment and for breach of fiduciary duty arising out of the alleged actions of P, another Russian national, in taking a secret commission and in fraudulently diverting sums from N’s personal bank account in respect of a number of property transactions.

- Acting as sole counsel for the sixth defendant on the defendants’ application to strike out a claim, which alleged fraudulent acts or omissions on the part of each of the defendants including substantive acts of dishonesty and/or fraud and the misappropriation of funds, and for an extended civil restraint order.

-

Arbitration

Joseph has experience of acting in significant institutional international arbitrations. Examples of current and recent instructions in this area, which is by its nature confidential, include:

- Advising and acting (with George Bompas KC) on the claimant’s US$8 million claim under LCIA Arbitration Rules for unpaid fees under an agency agreement

- Advising as sole counsel and acting for the potential claimant in connection with arbitration proceedings under CIETAC rules in Beijing arising out of a contractual dispute.

- Advising and acting as sole counsel for the claimant BVI investment vehicle on its arbitration proceedings under ICC rules in London against its Cayman Islands investment manager for damages on account of breaches of its tortious and contractual duties.

- Advising and acting as sole counsel for the defendant in connection with arbitration proceedings under ICC rules in London arising out of a contractual dispute.

- Being instructed by the Ministry of Defence as part of the counsel team in a multi-million pound arbitration in London relating to marine and terrestrial construction disputes (with Sarah Hannaford KC and Piers Stansfield).

-

Offshore Litigation

Ranked as a leading junior in both the Global edition of Chambers and Partners and the Middle East edition of The Legal 500, a large proportion of the cases on which Joseph is instructed have an offshore element, in particular litigation involving offshore trust and corporate structures. In addition to acting and advising in relation to such matters, Joseph appears regularly in the DIFC courts, being a registered advocate with rights of audience in that jurisdiction. Examples of current and recent instructions in relation to such matters include:

- Acting (with Sharif Shivji KC) in proceedings in the DIFC, in relation to an AED1.7 billion syndicated loan facility, which raised issues of duress, misrepresentation, and Sharia finance.

- Acting as sole counsel for the claimants on their substantial claim in the DIFC arising out of a share sale and purchase agreement to purchase the entire shareholding of a commodity trading business.

- Acting as sole counsel for the applicant company on its application to set aside an immediate judgment order enforcing a Singapore judgment in the DIFC.

- Acting (with Richard Hill KC) for the proposed claimant in relation to his potential claim in the DIFC for over US$4.5 million in damages on account of a DFSA-regulated bank’s misrepresentations and/or breaches of contractual and/or tortious and/or fiduciary duties as part of the banker-customer relationship.

- Acting (with Orlando Fraser KC) on behalf of the protector of two Nevis trusts on the trustee’s application for directions.

- Acting (with John Brisby KC) for the additional defendants in their application in the DIFC to strike out Barclays’ claim for a contribution in respect of the claimant’s claim against Barclays in deceit and/or negligence and/or unlawful conspiracy for damages of over US$24 million.

- Advising as sole counsel the proposed claimant BVI company in relation to its proposed claim against its investment manager, a Cayman company, for damages in excess of US$2 million on account of losses suffered on its investment portfolio

- Acting as sole counsel for the defendant Canadian company in relation to the claimant Maldives company’s £8 million claim for damages on account of the defendant’s alleged breach and/or anticipatory breach and/or repudiatory breach of contract.

- Acting (with John Brisby KC) for a former shareholder in a BVI company in relation to its claim for deferred consideration in excess of £4 million pursuant to a share sale and purchase agreement.

- Acting as sole counsel for the claimant, who was engaged as the defendant BVI company’s agent on its claim for damages on account of the defendants’ failure to pay commission in breach of an agency agreement.

Other information

-

Career & Appointments

- Member of the Commercial Bar Association

- Member of the Chancery Bar Association

- Member of the Insolvency Lawyers’ Association

- Registered advocate with rights of audience before the courts of the DIFC, Dubai

-

Education & Awards

- MA (Oxon)

- GDL, City University, London

- Middle Temple: Queen Mother’s Scholarship (2009); Lord Diplock Scholarship (2008)

- Oriel College, Oxford: Academic Scholarship (2006)

-

Publications

- Litigation in the Time of Covid-19, the 4 Stone Buildings’ E-Book.

-

What the Directories Say

Chambers UK Bar 2025- Chancery: Commercial, Band 4

- “Incredibly polite and user-friendly, he’s a smart barrister who writes well.”

- “He’s a boon to those that instruct him as he produces skeleton arguments quickly.”

- “Very considered in the way he works, Joseph is sensible and sensitive to difficult issues within cases.”

The Legal 500 UK Bar 2025 – Insolvency, Tier 4

The Legal 500 Middle East English Bar 2025 – Commercial, Tier 2

Chambers UK Bar 2024 – Chancery: Commercial, Band 4 & Chambers Global 2024 – Dispute Resolution: Commercial Chancery, Band 4:

- “Very personable, a good fighter and someone who really gets on top of the detail in a case.”

The Legal 500 UK Bar 2024 – Insolvency, Tier 4:

- Calm and measured approach in court; thorough preparation and willingness to pitch in as part of an overall team.”

The Legal 500 Middle East English Bar 2024 – Commercial, Tier 2

Chambers UK Bar 2023 – Chancery: Commercial, Band 4 & Chambers Global 2023 – Dispute Resolution: Commercial Chancery, Band 4:

- “Clever, thorough and very easy to work with.” “He is very responsive, tactically very sound, and both user-friendly and time-friendly.” “He is an excellent advocate, who is a very calm presence.”

The Legal 500 UK Bar 2023 – Insolvency, Tier 5

The Legal 500 Middle East English Bar 2023 – Commercial, Tier 2

Chambers UK Bar 2022 – Chancery: Commercial, Band 4 & Chambers Global 2022 – Dispute Resolution: Commercial Chancery, Band 4:

- “Extremely able and excellent on paper.” “He has an extremely impressive command of the law and is a devastating advocate.”

The Legal 500 UK Bar 2022 – Insolvency, Tier 5:

- “Joseph has excellent judgment and knows which points to fight and which points to drop.”

The Legal 500 Middle East English Bar 2022 – Commercial, Tier 2:

- “He is excellent. Strong legal skills while at the same time user-friendly and very sensible. He understands the demands of his clients and manages them well.”

Chambers UK Bar 2021 – Chancery: Commercial, Band 4 & Chambers Global 2021 – Dispute Resolution: Commercial Chancery, Band 4:

- “He impresses with his thorough approach. He is very responsive and willing to add well considered comments on points of real detail, keeping in mind the overall objectives of the client in the case. He handles exceptionally complex and extensive pleadings with conviction and is a very valuable member of the team.” “Very accessible, user-friendly and excellent in court.”

Chambers UK Bar 2020 – Chancery: Commercial, Band 4, & Chambers Global 2020 – Dispute Resolution: Commercial Chancery, Band 4:

- “A talented junior who is building a considerable reputation among the Commercial Chancery Bar. He is regularly instructed on a wide array of matters, including notable capabilities in contentious insolvency and commercial litigation.”

- “Joe is a great junior barrister who is user-friendly, impressive on the law and robust on his feet.”

- “He’s thorough, tenacious and extremely knowledgeable in relation to the technicalities of insolvency law.”

Chambers UK Bar 2017 – Chancery: Commercial, Up and Coming:

- “Promising junior with experience of handling insolvency and general commercial litigation in the Chancery Division. He represents clients in UK-based and international cases.”

- “He has an excellent grasp of the issues and is a pleasure to work with.”

Chambers UK Bar 2016 – Chancery: Commercial, Up and Coming:

- “A well-regarded junior who is building a wide-ranging and impressive practice.”

- “He has taken significant instructions in the areas of insolvency and is good at commercial disputes generally.”

- “Certainly one that the market should keep its eye on due to his ability to work hard, take on responsibility and deliver when under pressure.”

![Giwa v JNFX Ltd [2025] EWCA Civ 961– Arnold LJ; Nugee LJ; Sir Launcelot Henderson](https://4stonebuildings.com/wp-content/uploads/2025/08/JW-website.png)

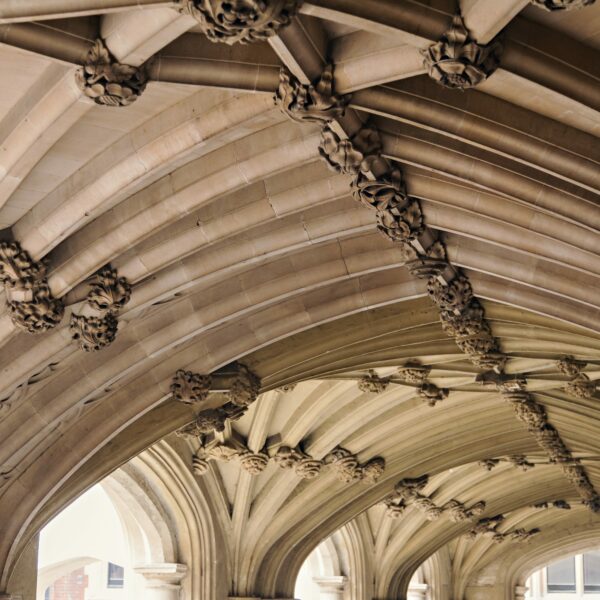

![Judgment handed down in Adie v Ingenuity Digital Ltd [2024] EWHC 2902 (Ch).](https://4stonebuildings.com/wp-content/uploads/2024/09/Generalviews-191-600x600.jpg)